Below you can read our view on various ideas on investing your hard-saved capital. To learn more about forex managed accounts and the opportunities provided – click here.

If you have the opportunity to invest 1 million pounds and you are looking for the best way to invest it, before you chose where, you should consider a number of issues.

One of the main things to think about and is also well-known saying is, “Don’t put all your eggs in one basket”.

READ ALSO: Best Trade Forex For Me Service 2023

Even if you have done your due diligence and you think a certain investment type is safe, there will always be a degree of risk involved. There are low-risk and high-risk investments, but no-risk investments are effectively nil.

Therefore, the clever way to invest a million pounds would be to spread the risk.

If you want to compare performance results and fees of traders who will trade on your behalf, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Diversification is a way to lessen this risk by distributing your funds throughout a variety of investment vehicles such as stocks, bonds, mutual funds, business, property and alternative investments, to name but a few.

As a general rule, the higher the return on investment, the greater the risk. Low-risk investments will typically yield very little.

This website is on the subject of foreign currency exchange investments. Moreover, it is about managed forex accounts at the time of writing this article, although it has started to explore other forex openings.

I won’t go over the subject too much on this page because I have covered the topic in-depth throughout this site. I just want to show you how much profit is achievable using these accounts.

DON’T MISS: Compare Best Forex Managed Accounts 2023

In a nutshell, though, managed forex accounts are foreign currency exchange accounts traded by professional traders and managed by a management company for the investor.

The management company makes their money by charging performance fees and admin costs in some cases.

The investor supplies the forex broker with a “Limited Power Of Attorney” to permit the trader to undertake to trade. The client has total control of their own account and can credit and debt funds and close the account when they want.

Investing 1 million pounds in a managed forex account can be a higher risk than many other types of investments. However, these risks can be mitigated to a great degree by choosing one that A. is regulated by the Financial Conduct Authority (FCA) in the UK, for example, and B. has a 3rd party audited proof of profits.

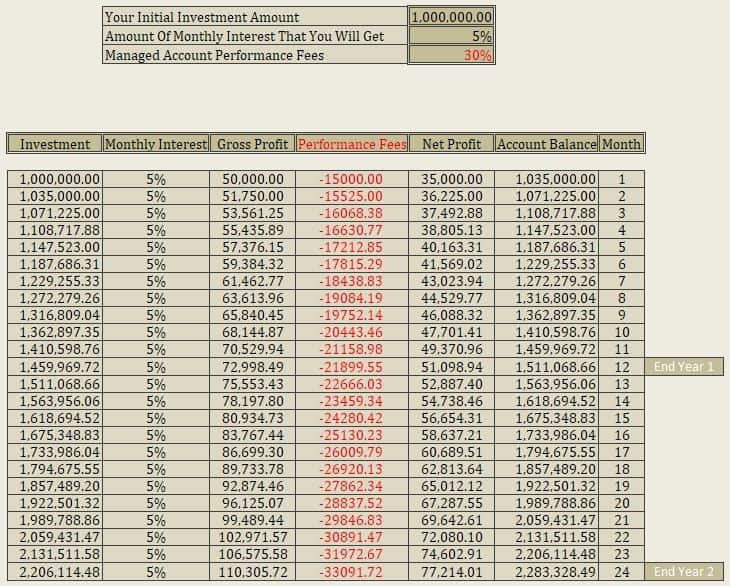

As an example of profits that can be made with £1,000,000 pounds, please check out the image below. These figures are based on an initial investment of 1 million pounds, a 30% performance fee and an average monthly return of 5%.

As you see, after one year, the initial investment of one million pounds has accrued to a value of 1.5 million pounds. After two years, the value has risen to almost 2.3 million pounds.

READ ALSO: Compare Best Forex Brokers 2023

There are two types of investors that invest their money into a managed forex account, those that want a monthly income and those that want to let their money compound in their accounts for capital growth.

Some people take out half profits for a monthly bonus and let the rest compound. Some withdraw profits until their capital is recovered and just let the rest accrue in the account.

Is this the best way to invest 1 million pounds? Or any other amount from £10,000 pounds upwards, the answer to that is different for everyone. It depends on your end goal, monthly income or capital growth, low or high risk, low or high returns on investment.

If you want to compare performance results and fees of traders who will trade on your behalf, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements